tax sheltered annuity calculator

403 b Carruth Compliance Consulting Third-Party administrator for 403 b Plan compliance List of Vendors 403 b Online 403 b Annuity. B3 divided by C3 2 Tax-free part of annuity.

Mortgage Calculator Click Quote Save

This calculator assumes that your return is compounded annually and your deposits are made monthly.

. The employee will not pay any taxes on their. However if the taxpayer contributes fully to a traditional 401 k the maximum contribution in 2022 is 20500 their 2022 taxable income would be reduced to 179500 200000. A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts.

Retirement savings contributions credit. Dear Allen If you were born before Jan. It is also known as a 403b retirement plan and.

When considering making an early withdrawal from your retirement savings it is important to understand the potential impact of such a decision. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. Generally pension and annuity payments are subject to Federal income tax withholding.

Please use our Annuity Payout. There are 5 important reasons why Tax Sheltered Annuities are a great investment. The most common tax-sheltered.

The Early Withdrawal Calculator the tool. When you receive income payments from your annuity as. The actual rate of return is largely dependent on the types of investments you select.

IRC 403 b Tax-Sheltered Annuity Plans A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. With this calculator you can find several things. Tax-Free Part of Annuity 1 Exclusion ratio as a decimal rounded to 3 places.

The withholding rules apply to the taxable part of payments from an employer pension annuity. C1 times D1 If your annuity meets the three conditions listed in. For 2021 the adjusted gross income limitations have increased from 65000 to 66000 for married filing jointly filers.

ERISA Coverage Of IRC 403b. The TSA account is taxed only when it is withdrawn or individuals start receiving payment. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are withdrawn from the.

Whats New for 2021. The tax-free part is considered the return of your net cost for purchasing the annuity. The rest is the taxable balance or the earnings.

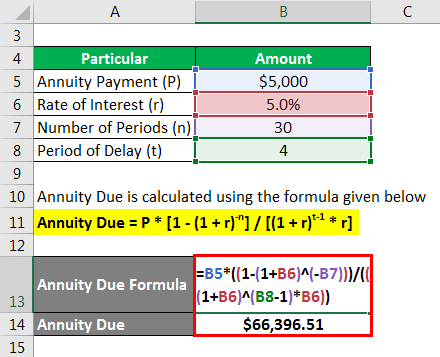

Whether it is an immediate or deferred annuity each part of the payment represents a return of the original investment plus the earnings on the investment. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement. Annuity Calculator The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits.

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. A Fixed Annuity can provide a very secure tax-deferred investment. An annuity is an investment that provides a series of payments in exchange for an initial lump sum.

Tax Sheltered Annuities What Are They And Who Are They For

Top 20 Companies For Annuity Sales 2013 Thinkadvisor

The Best Annuity Calculator 17 Retirement Planning Tools

How To Figure Tax On Inherited Annuity

Deferred Annuity Formula Calculator Example With Excel Template

The Tax Sheltered Annuity Tsa 403 B Plan

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Annuity Taxation How Various Annuities Are Taxed

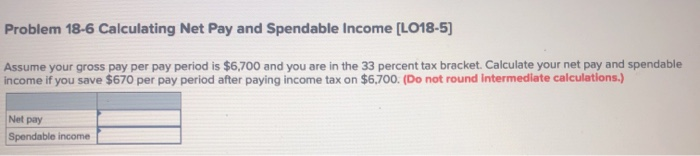

Solved Problem 18 6 Calculating Net Pay And Spendable Income Chegg Com

Business And Finance 403 B Tax Sheltered Annuity Documents

Annuity Life Insurance Solutions Brighthouse Financial

The Best Annuity Calculator 17 Retirement Planning Tools

What Is The Tax Rate On An Inherited Annuity Smartasset

The Best Annuity Calculator 17 Retirement Planning Tools

Can I Buy An Annuity With My Ira Or 401k Immediateannuities Com

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)