how to calculate sales tax in oklahoma

Web This is a printable Oklahoma sales tax table by sale amount which can be customized by sales tax rate. Web Oklahoma also has a vehicle excise tax as follows.

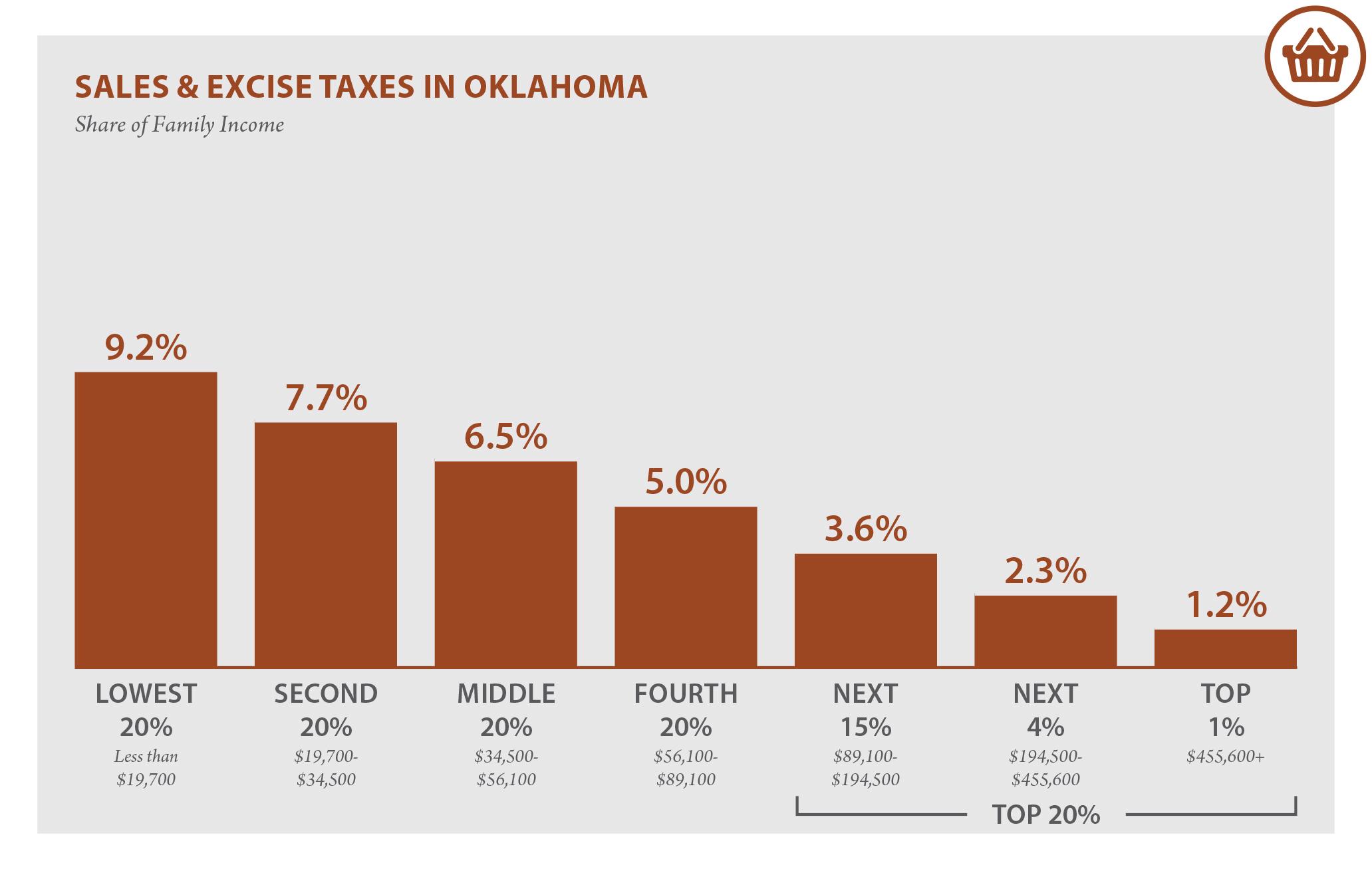

General Sales Taxes And Gross Receipts Taxes Urban Institute

325 percent of the purchase price.

. Web To know what the current sales tax rate applies in your state ie. Web The Oklahoma state sales tax rate is 45. The average cumulative sales tax rate in Oklahoma City Oklahoma is 875 with a range that spans from 85 to 95.

Income tax 05 - 5. Depending on local municipalities the total tax rate can be as high as 115. This includes the rates on the state county city.

Web We would like to show you a description here but the site wont allow us. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate. Web Oklahoma Income Tax Calculator 2021.

Average Local State Sales Tax. Alone that would be the 14th-lowest rate in the country. In Oklahoma this will always be 325.

Web The average cumulative sales tax rate in Tulsa Oklahoma is 871 with a range that spans from 852 to 98. Web The Oklahoma OK state sales tax rate is currently 45. Oklahoma all you need is the simple calculator given above.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. Enter the Amount you want to enquire about. Web Oklahoma State Sales Tax.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 828 in Tulsa County. Multiply the vehicle price before trade-in or incentives by. The minimum is 725.

Web Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Web Oklahoma State Taxes. The calculator will show you the total sales tax amount as well.

However in addition to that rate. Web The base state sales tax rate in Oklahoma is 45. The state sales tax rate in Oklahoma is 450.

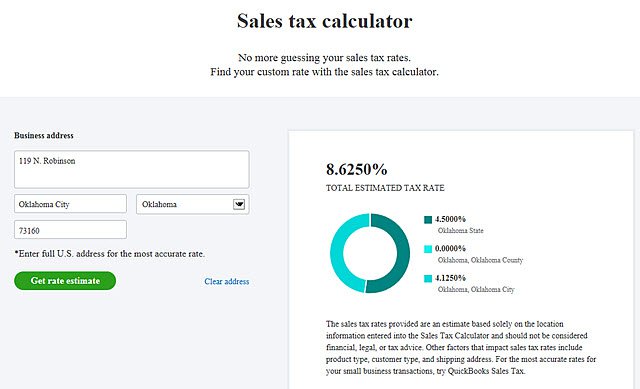

Web You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code. Web The oklahoma city sales tax rate is 8625 taxing jurisdiction rate oklahoma state sales tax 450 oklahoma city tax 413 combined sales tax. Multiply the vehicle price by.

Maximum Possible Sales Tax. 20 on the first 1500 plus 325 percent on the. Multiply the vehicle price after trade-ins.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Maximum Local Sales Tax. Web To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Web Sales Tax Table For Tulsa County Oklahoma. In Oklahoma this will always be 325. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the.

Other local-level tax rates in. This chart can be used to easily calculate Oklahoma sales taxes. Web To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Web Oklahoma Sales Tax. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 771 in Oklahoma. Web Sales Tax Table For Oklahoma.

States have the right to impose their own taxes on. Web To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Your average tax rate is 1198 and your.

This includes the rates on the state county city and special.

State Sales Tax Rates Sales Tax Institute

Etsy Marketplace Collects Sales Tax For You Accounting For Jewelers

How To Calculate Sales Tax And Final Price Youtube

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Beginner S Guide To Dropshipping Sales Tax Printful

A Complete Guide To Oklahoma Payroll Taxes

How To File And Pay Sales Tax In Oklahoma Taxvalet

How Do State And Local Property Taxes Work Tax Policy Center

Oklahoma Sales Tax Calculator And Local Rates 2021 Wise

E Commerce And Sales Taxes Osu Fact Sheets Oklahoma State

What You Must Know About Sales Tax If You Have Customers In The United States Quaderno

Quickbooks Launches Sales Tax Calculator Site Insightfulaccountant Com

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Charge Your Customers The Correct Sales Tax Rates

Oklahoma Voters In Texas County To Determine Sales Tax To Benefit Memorial Hospital Kvii